Agriculture Credit Lending in India: A Context

In India, agriculture is a major sector of the economy, employing more than half of the population and contributing around 18% to the GDP. However, access to credit remains a major challenge for farmers, especially small and marginal farmers who constitute a large part of the farming community.

India has an estimated 12.56 crore small and marginal farmers, according to the Agriculture Census of 2015-16, who together operated over 86 per cent of total farm holdings and held 47.34 per cent share in the operated area. Small and Marginal Farmers comprise 86% of the total farmer population, approximately half had no access to institutional credit, while as per a MicroSave report, out of those who borrowed, 59% or 36 million accessed formal credit while 41% relied on informal credit.

While farmers have their challenges, one of the reasons for this low credit penetration by credit lending institutes is the high risk associated with lending to farmers. Banks in India have to follow the priority sector lending (PSL) guidelines for agriculture. Targets under priority sector lending (PSL) for Agriculture sector categories as ‘Advances to Agriculture Sector at 18 percent of Adjusted Net Bank Credit’

Agriculture is inherently a highly risky business, where farmers face natural challenges such as drought, flood, pests, and diseases that lead to crop failure. In addition, farmers often lack collateral to secure loans, which makes it difficult for them to access credit. On the other hand, banks face challenges in assessing the creditworthiness of farmers due to the lack of reliable data on their income and assets. Many farmers, due to having no formal credit history are new-to-credit farmers.

The True Problem of Credit Access: A Farmer and a Banker Perspective

Despite the widespread availability of digital services, there is still a significant disparity in the accessibility of digital services in rural areas, especially when it comes to agricultural services. The process of applying for agricultural loans can be arduous, which is why our team member embarked on a field visit to Madhya Pradesh and Uttar Pradesh to implement a Business Correspondent model with our partners for one of India’s largest public sector banks. By connecting with branch managers, extension officers, farmers, and NGOs in the agricultural sector, we gained invaluable insight into the pain points of farmer onboarding and loan disbursement. At SatSure, we take pride in documenting and analyzing these real-life situations to develop a decision intelligence framework that addresses the needs of our clients and product users.

A Cumbersome Task at Both Ends

As we spoke with bank executives about the farmer onboarding process, we were surprised to learn about the extensive paperwork involved in assessing different types of loans, including the Kisan Credit Card (KCC) program, which aims to provide farmers with access to credit for their agricultural needs.

The process begins with customers submitting an application form and KYC documents. After that, the field staff must compile a considerable amount of paperwork to assess the creditworthiness of the farmers. This paperwork can be quite time-consuming and tedious.

In addition to the application form and KYC documents, farmers are also required to produce Khasra/Khewat documents, which are essentially the land records, and other relevant documents or field photographs. This is an essential step in the process, as it helps the bank verify the farmer’s land ownership and assess their creditworthiness.

While this process may seem cumbersome, it is crucial in ensuring that farmers have access to the credit they need to grow their businesses. By streamlining this process, we can make it easier for farmers to obtain the credit they need to thrive and contribute to the growth of the agricultural sector.

The Current Process of Obtaining a Loan

The process of obtaining agricultural credit in India is a burden for farmers. The extensive paperwork required by banks to assess creditworthiness often overwhelms farmers, leading to a high rate of loan application withdrawals. Small-ticket loans, which are mostly needed by small-acreage farmers, require extensive documentation and verification. Private banks provide better customer service, but only offer high-ticket loans to larger farmers.

Furthermore, farmers are required to bear upfront costs for official documentation and verification, sometimes as high as INR 2000. Even after the verification process, field managers must visit farms and households to ensure timely repayment of loans. Such processes are time-consuming, expensive, and often lead to delays in loan processing.

In rural areas, the situation is even worse, with fewer branches, poor connectivity, and fewer staff, leading to one branch catering to a large population across multiple villages. This results in a delay in loan processing, causing farmers to suffer.

While such verifications are important, the need for digital disruption in the agricultural sector is urgent. The automation of the end-to-end processing of KCC loans will make the process more efficient and less burdensome for farmers. It is essential that the banking sector prioritize the adoption of digital technology to better serve farmers in India.

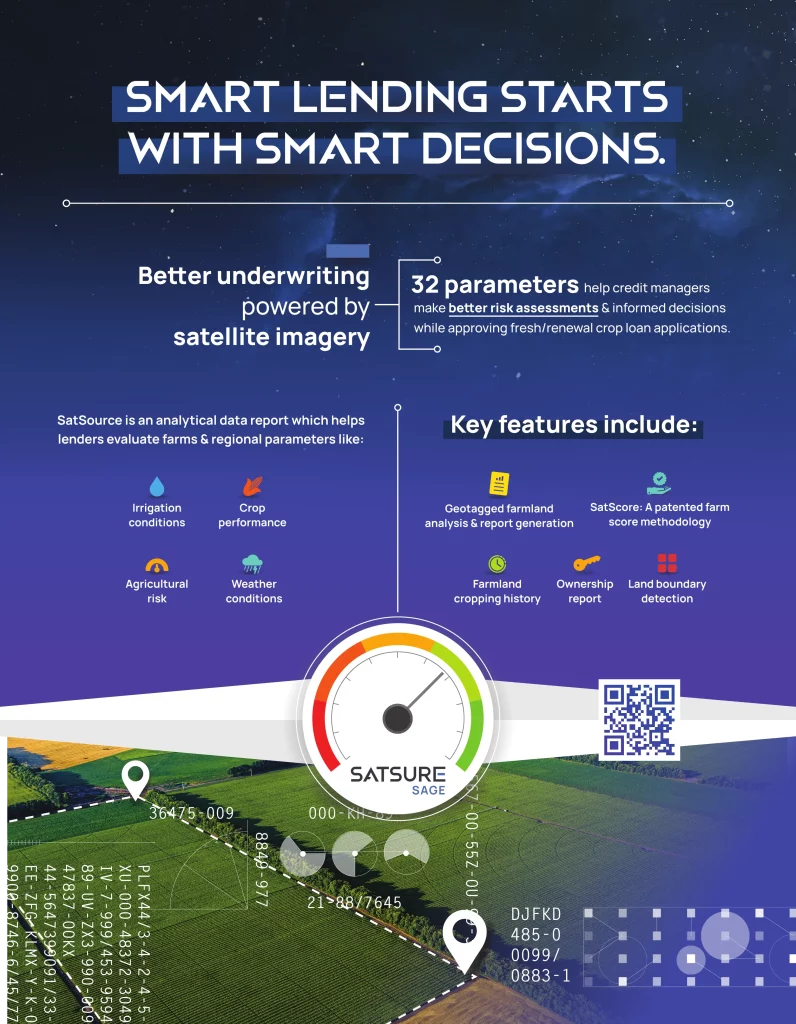

Making Underwriting Smarter with Satellite Imagery

Satellite remote sensing can play a critical role in improving the access to credit for farmers. Satellite remote sensing refers to the use of satellites to collect information about the earth’s surface, which can be used to monitor crop health, crop moisture, crop production and other important parameters. The availability of archival data from satellites is today helping banks in India and is helping banks access credit lending risk better.

SatSource report has 32 parameters which help evaluate a farm land for the underwriters.

The modularized SatSource report serves as a valuable tool for banks in making informed decisions for loan underwriting and farmer onboarding. By providing credit managers with access to critical information such as land location (digitized by respective government departments), cropping histories including sowing and harvesting, crop performance and yield, weather insights, irrigation conditions, and market data sourced from government and public sources, the report enables them to assess risks associated with small and large holdings, create pre-approved loan products, and reduce the turnaround time for new loans and renewals.

One of the significant advantages of the report is its ability to help identify fraud instances by remotely accessing cropping history and comparing it with crops reported by farmers to better understand their loan requirements. This can help credit managers evaluate the crops grown versus the crops reported, reducing the risk of fraudulent activity.

It is worth noting that the report’s effectiveness may depend on the availability of digitized land location data by government departments. In the absence of digitized data, accessing and utilizing relevant information could be more challenging.

Add comment