The year 2023 saw many events that brought back our attention to climate change and its impact on the agricultural sector. In India, for instance, North India faced heavy flooding during the Kharif cropping season, impacting some of the major crop-producing states in India, Haryana, and Punjab. A consequence of this was a ban on exports of Basmati rice from these states, impacting farmer liquidity, production capacity, and credit recovery for banks.

Maharashtra, a state in western India, faced a 13% reduction in monsoon rainfall, affecting 177 out of 395 tehsils with a rainfall deficit of 5-10%. The State declared a “severe” drought in 24 tehsils and a “middle-level” drought in 18 tehsils.

A government resolution on October 31 outlined immediate relief measures for affected areas, including discounts on revenue receipts, crop loan restructuring, farm loan recovery suspension, a 33.5% reduction in agriculture pump meter bills, and the waiver of school and college fees for students.

Both these instances highlight the increasing risk due to natural events triggered due to erratic weather and climate change and their impact on agriculture and associated sectors, like credit lending.

Climate Change and Financial Exclusion: A Risky, Vicious Circle

The rise of secondary perils has demonstrated the lack of readiness and the increased risk due to exposure in agricultural credit for banks, clearly visible in the struggle banks face to control Non-Performing Assets (NPAs) in rural lending. However, are banks aware about the risks associated with climate change and how it may impact their decision-making?

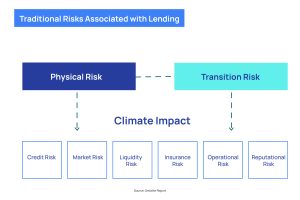

The image below from a Deloitte report shows how financial leaders are well aware of the traditional risks associated with lending like credit, market, liquidity, insurance, operational, and reputational risks.

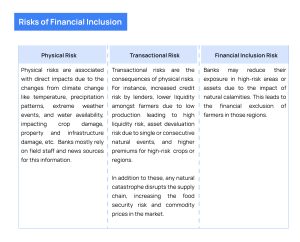

However, a combination of these is a result of the impacts of climate change. We are categorizing the risks of financial inclusion into three buckets:

A survey of 167 agricultural finance institutions by the Deloitte and Environmental Defense Fund highlights that the biggest barriers to action on climate change are:

Figure: Top challenges preventing agricultural finance institutions from taking more action to address climate impacts

Figure: Top challenges preventing agricultural finance institutions from taking more action to address climate impacts

The above image highlights the top three demotivators that financial institutions perceive as limiting them to climate action initiatives. The top spot is for lack of data infrastructure which can support them in a granular, transparent, and a proactive system to gauge a risk. The second and third highlight the motivation and internal capability to build a system backed by newer technologies. In the context of agricultural lending, for instance, the extent of damage to crops cannot be measured purely on field visits due to operational challenges and scale of impact, which otherwise is easily identified using insights from earth observation data.

To solve the problem of a robust data infrastructure, investment in digital transformation and innovative technologies to support lending decisions is a must for lending institutes.

Expanding Opportunities with Satellite Remote Sensing

Climate change works in different ways for different regions. A lot of external parameters influence the impact of climate change like terrain type, elevation model, natural resources like water bodies, forest areas, settlement area and population density, extent of urbanization and agriculture etc. The increase in secondary perils has led some regions to experience floods or droughts frequently which used to happen once a decade in these regions. Without the necessary infrastructure or technology to help mitigate the impact and risk, banks face the challenge of being unprepared to tackle these impacts.

Satellite remote sensing is one such technology which helps banks proactively manage risk and build a risk management and mitigation framework which helps them navigate the shocks of climate change impact. Satellites navigate the earth at more than 700 kms above sea level. Presently most of the ‘open access’ imagery sources used for agriculture monitoring is a spatial resolution of 10m/pixel whereas the commercially available imagery has a one order difference of 0.3m/pixel.

Satellite imagery analytics revolutionizes crop monitoring for bankers, enabling precise assessment of crop health, soil moisture, and weather patterns at scale. The availability of data at small farms reduces the need for frequent customer visits, cutting loan management costs. Moreover, it ensures loan proceeds are used for farming purposes through transparent farm monitoring. By transparently sourcing farmer customers, bankers can expand their portfolios strategically, leveraging micro-market insights for optimal lending decisions. This rewards diligent farmers and promotes sustainable land management practices. Historical analysis offers valuable insights into cropping patterns and water resources, guiding loan officers to underwrite effectively.

SatSure Sage is a suite of applications that facilitate smart decision making in management of agricultural loans by lending institutions. It leverages the power of satellite data and location intelligence to bridge information gaps, which helps lending institutions to smartly scale while reducing operational cost, and at the same time, helps farmers to get access to credit.

It is thus an important decision for banks to adopt advanced technology like satellite remote sensing in credit lending decisions. With satellite technology, bankers can mitigate risks while expanding their loan portfolios intelligently, fostering confidence in agricultural financing. To know more about how SatSure Sage can help your bank improve decision-making for crop lending with insights from satellite imagery, reach out to us at info@satsure.co.

Add comment