Introduction

Bram Spann has over 10 years of working experience for Rabobank in different roles like relationship manager and product manager. Since early 2019, he is responsible for a part of Rabo Foundation’s Asia portfolio as a program manager, covering India, Myanmar and Sri Lanka.

Bram is passionate about (blended) finance solutions, impact management and building networks. Furthermore, he is keen on innovation in the agricultural sector (AgTech), specifically addressing the challenges of the smallholder farmer.

Q) How has the Rabo Foundation’s Vision evolved since its inception in 1974?

Bram: Rabo Foundation is the foundation of Rabobank, a full-fledged retail bank in the Netherlands and globally one of the leading financial institutions in Food & Agri. Rabobank started as a farmer cooperative in the late 1800s , and the primary idea of setting up the foundation was to pay tribute to our farming roots. Initially, we were providing only grants, but over the years we found that this way of support wasn’t sustainable enough. For this purpose, we started providing loans and other types of financial instruments towards supporting farmers and generating the required mindset of repaying loans. Rabo Foundation aims to move farmer organisation or the individual smallholder farmers towards self-reliance, meaning in most cases that they can get access to finance from local financial institutions. These financiers will not provide them with any grants either, so this mindset of repaying loans is paramount for a sustainable financial future.

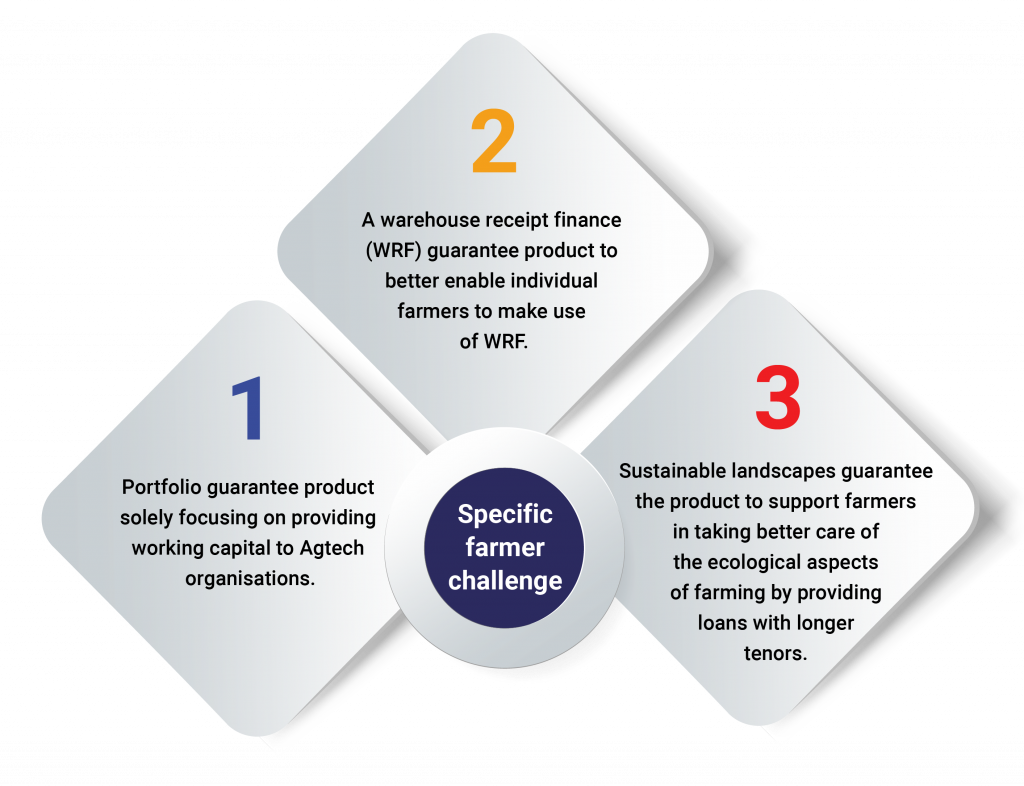

For example, in India, we have launched several credit products – with every product to addressing a specific farmer challenge. To name a few:

- Portfolio guarantee product solely focusing on providing working capital to Agtech organisations.

- A warehouse receipt finance (WRF) guarantee product to better enable individual farmers to make use of WRF.

- Sustainable landscapes guarantee the product to support farmers in taking better care of the ecological aspects of farming by providing loans with longer tenors.

The most important aspects of our evolution as a foundation are the developments in the way we measure impact and the fact that we have set up a separate innovation department within the foundation. We found the latter development necessary since we are sure that innovation will ignite the next revolution in agriculture.

With impact financing, we can help farming organisations, but by supporting innovative organisations we are systematically bridging the gap in the longer run, especially in the agricultural sector where innovation is required like nothing else.

Q) What are the different financial instruments using which the Rabo Foundation supports small organisations?

Bram: In the classical Rabo Foundation model where we finance a farmer organisation, we provide a loan for working capital in many of the cases to meet the farmer organisation’s finance requirement for the season. This is done at a competitive interest rate not to disturb the local financial system. Additionally, this comes with a technical assistance grant to a training organisation that is provided for a longer period to build the capacity of a specific rural beneficiary.

In India or Myanmar, we mainly use credit guarantee instruments which is required because of the respective local regulation we have to deal with. Hence, we had to reinvent ourselves and needed to come up with new products that fit the farmer’s credit needs equally well as a loan product.

In that sense, a credit guarantee can be an even better instrument, since we can push local financial institutions to take more risk in reaching out to the smallholder farming community. In this way, institutional capital can be unlocked, and the involved financial organisations can be made more comfortable with the target group without running too much risk. We see this as a more sustainable model for the long run for all parties involved. However, every country is different, so we have to tailor these programs to the needs of the stakeholders and rules and regulations per geography.

Therefore, these credit guarantee products cannot be easily replicated in other countries, but provide an excellent finance corridor for our support in India and Myanmar.

Q) Can you please share your experiences or learnings, especially in India, Southeast Asia geographies, about the projects that Rabo Foundation has been financing in towards smallholder farmers financial inclusion?

Bram: Talking specifically about the team in India, we went through a steep learning curve. We started 15 years ago, which involved mainly grant-making and bilateral transactions with clients. Even though the impact is there, these bilateral transactions in India are like a drop in the ocean, when you talk about impact.

So, we understood that working with and building a network of partners in a country like India is the best way to find projects and scale them.

Initially, we started off with one person (Mr. Arindom Datta, Executive Director, Rural & Development Banking/Advisory, Rabobank), who built these networks and found the right local partners. That was the platform from which the setup of our local team was crafted. By the time it was 2014-2015, like-minded ecosystem players also entered the scene like NBFCs that provided financial opportunities to smallholder farmers as well.We started providing working capital to Agtech players after our innovation department was set up around 2017-2018. The development over time from more an NGO kind of organisation to an ecosystem-oriented impact financier was a was valuable insightful lessons. One of them is that innovation and technology play a crucial role in providing a platform for smallholder farmers to increase their livelihood and income.

Q. Talking about network and partners, what are the criteria of validating or scouting partners to align with Rabo foundation’s objectives?

Bram: There are two defined ways for validating this – first is through our network, especially in the countries where we have a local presence like in Indonesia, India, Peru and Kenya. Our network is relatively vast and extensive in these countries, since we have been locally active for a longer time. Because of this long-term presence, we know which partners are relevant and deliver good quality. In terms of leads, network and partners play an essential role in our activities, and it helps us evaluate which partners we should work with and which not.

The second aspect of how we look at our investees is through our potential impact model. This was set up last year and is based on different variables. We check if the organisation that we are going to work with can reach a certain maturity stage in which they generate a specific impact. And that opportunity of creating impact most of the times exists, since there are always sectors and geographies in a country where other financial institutions don’t dare to step in. As long as there are no other financial institutions to provide the necessary support to the rural community, our role is very relevant.

Q. There are several multi-lateral organisation that are getting into the financing of Agtech start-ups and supporting smallholder farmers – something that the Rabo Foundation has been doing for years now. In the event of such increasing interest in the agriculture finance sector, including philanthropic contributions, how do you see your organisation’s role within the ecosystem, and the role of people like yourself who are building the business partnerships?

Bram: We always try to have a clear ‘Food and Agri’ focus, which gives us a unique identity as Rabo Foundation. Many other foundations have Agriculture as a sector of interest in their portfolio, but to them it’s in most cases only one of the many pillars. Also, we are the only foundation in the world that can provide financial instruments through Rabobank itself and use extensive data knowledge that Rabobank has built up over recent years. Our innovation department can therefore, be really hands-on when it comes to the technical support of Agtechs’. This is a real add-on to our product portfolio.

In this way, together with Rabobank’s knowledge and network in the global Food and Agri space, we positioned ourselves in the best way possible to make a real impact in the agricultural sector.

Q) It is an exciting model that Rabo Foundation is linked with the Rabobank – the world’s largest food and Agri bank. So, there is a tremendous amount of expertise you have, especially with a network of early to growth stage Agtech start-ups partners. Is there any partnerships that Rabo Foundation or Rabobank have in India with large banks like ICICI, HDFC, SBI etc., as they are servicing more smallholder farmers than any of the Agtech’s?

Bram: In many countries, large banks mostly look for the low-hanging fruit and usually around urban or semi-urban areas. Unfortunately, and perhaps because of this, they are very hesitant to move into deep rural areas because appraisal and origination of loans involves a time – consuming process, and therefore the transaction costs are very high. We don’t have to tell these larger institutions about how to serve this rural segment. They mostly have the knowledge available, but not the channel or technology. So, we see a big role to play for Agtech platform organisations, which can function as an intermediary to the smallholder farmer.

Hence, we are trying to set up a new program to enable these collaborations and of which I am sure it can become a gamechanger for the whole sector.

Q) From my experience, there is a need for lending organisations to build internal capacity for delivering digital transformation projects, especially in rural banking, where innovative technologies will form an integral part. Do you see Rabo Foundation, with its deep sectoral experience and dedicated innovation team, playing a role here – for providing advisory and consultation to banks, since it could help you reach your impact targets faster due to the scale of these organisation?

Bram: It’s good to know that Rabobank has a separate advisory arm (Rabo Partnerships). They primarily focus on the development of commercial banks in emerging economies. Agri financing is always a certain part of this development, since the rural population in many emerging economies represents a significant part of the total population and therefore, cannot be neglected. Especially, not as an advisory team of a Food and Agri bank. Such a development can, of course, help Rabo Foundation in unlocking more mainstream capital to the smallholder farmer. Most farmers nowadays already get credit from loan sharks and repay them as well, but at a higher interest percentage than they can get from a traditional bank. The high-risk perception that most of the traditional banks have for rural financing is therefore, in most cases not legitimate. Providing evidence and and sufficient data to improve this risk perception to extend more credit products to these under and unserved markets is one of the more significant challenges.

Q) The Foundation has backed many technology driven pilot projects in the developing world. How are you involved post the pilot is completed successfully, towards scaling the impact?

Bram: In most cases, when we exit the organisation after project completion, the project scaling is taken up by our partners. Where we can have the most added value is to sit with the organisation in the initial stage and to indicate what kind of development we would like to see togther and how we can help in that development. We always link this to certain indicators. When we have defined that gap, we are going to investigate how we can move the project to full scale- up.

After the project completion, we have several options to continue supporting our partners. In the case of Agri companies, we can make use of our Rabo Rural Fund (https://www.rabobank.nl/over-ons/rabofoundation), which usually starts from $1 million support up to $3 million.

In this way we can provide the organisation with a ‘soft landing’ to a like-minded sister organisation. The funding gap can be fulfilled in this way, and as a foundation, we exit the client. In Agtech organisations, we usually see equity investments coming in overtime with which the company can be scaled. After such transactions, the credit appetite of the organisation will quickly be superseded by our own credit limits, and our work will be done. In many cases, we try stay involved from a joint learning perspective, maintain the valuable relationship.

Q) We were talking about innovation in agriculture for financing and you have been supporting so many companies across the globe. Is there any tangible behavioural change brought by these Agtech companies amongst banks?

Bram: Our goals are focused on developing an Agtech organisation in such a manner or Agtech that their innovation will accommodate smallholder farmers’ needs. Our support mostly extends to the developing world where farmer’s low income is still an issue, so increasing that income is one of our key objectives. The mindset of the employees of mainstream banks will also need to be broadened to focus more on the smallholder farming community.

If we can connect farmers with Agtech platforms that can provide credit from a financial institution, which more or less becomes a ‘one-stop shop’ for them, the farmer’s ability to earn more and repay money in general increases. This is the behavioural change that we would like to see. Unfortunately, this is yet to be fully operationalised in other geographies, but in India, there are already a few examples where we have been involved. In addition, the climate challenge doesn’t aid mainstream banks in their risk perception of the smallholder farmer as an asset class, since the farmer is the most vulnerable group to freak weather events. Therefore, together with the farmer’s impact on the environment, we have made an environmental impact one of the key elements of our new 2020-2025 strategy.

Here lies a big task for impact organisations like ours to come up with solutions that will prevent financial institutions from drawing back from the rural areas because of these higher perceived risks. Again, we cannot do that by ourselves, but we will need mission-aligned partners to push these boundaries together. These relationships have been built over the years and will be made in the coming years, all in the best interest of the smallholder farmer.

This article was originally published in The SatSure Newsletter (TSNL)