Introduction:

Akash Yalagach is currently the AVP – Defence and Space at SatSure, primarily working towards building a fleet of EO satellites along with other initiatives under the new vertical. Previously, he was at the Vikram Sarabhai Space Centre of ISRO for 6+ years as an AIT engineer for all launch vehicles. He completed his undergraduate studies in Aerospace Engineering at the Indian Institute of Space Science & Technology and was a Commonwealth Scholar at the University of Surrey, where he pursued his masters in Space Engineering.

We live in a society exquisitely dependent on science and technology, in which hardly anyone knows anything about science and technology – Carl Sagan

A technology that is seamlessly adopted by society and does not call for special skills to embrace can be safely assumed to have achieved economies of scale and found a valid application that connects with the civilisation. This can be witnessed from the penetration of smartphones or the internet in our lives. Nobody wonders how the internet links billions of people worldwide with its undersea optical fibre cables or how a smartphone packs so much computational power in such a small form factor. Much of the technology has benefited from the miniaturisation of electronics and declining costs of fabrication and assembly.

The satellite industry has also benefited from the advances in the electronics industry. Satellites have become smaller and yet are able to function better or match the performance of earlier generation satellites. In the space industry (which is still considered very high tech, well, after all, it is rocket science!), SatCom and navigation satellites have already achieved scaling the commercial application of its services. It is tough to imagine our day-to-day lives without GPS, which is critical for the smooth functioning of our society¹ . In addition, direct-to-home television has become commonplace in every household, although OTT platforms have started giving DTH a run for their money beyond the cities. Further, large corporations such as SpaceX and Amazon are coming closer to providing the promised 24×7 internet connection with global coverage directly from space. Thus, satellites have ubiquitously impacted our lives and will continue to be an indispensable part of our daily lives².

I believe this stat is taking from a single report of NSR. So we can just say As per reputed market research firms such as NSR, the Satellite Earth Observation (EO) industry is flourishing at 9.2% CAGR and $60 billion in revenue potential in the next decade³ . It is well known that the small satellite revolution has taken the EO industry by storm, with 389 smallsats being launched in 2019, of which 26% were EO satellites4. Furthermore, it is predicted that the global pandemic has not put any brakes on the EO industry5 as remote asset monitoring demand grew rapidly across the globe.

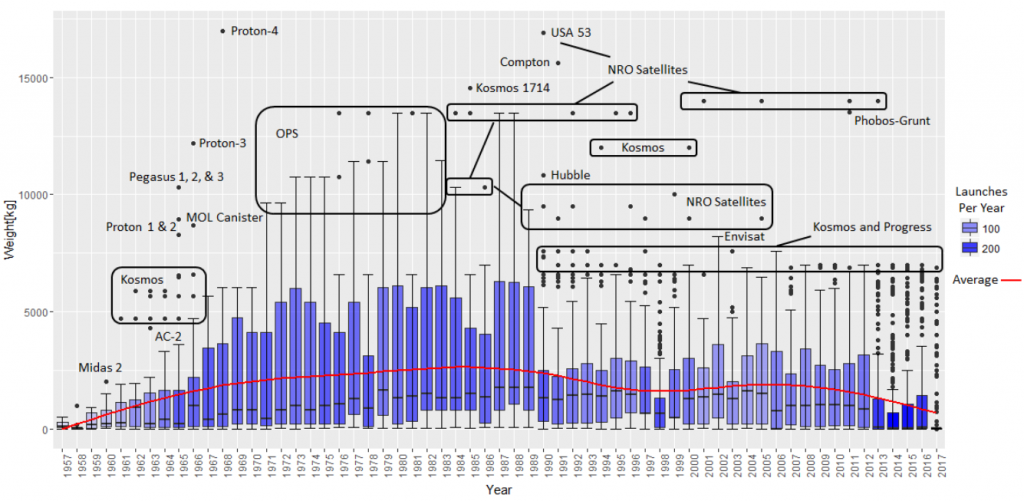

Figure 1: Mass of satellites over the years – Source: Global Trends in Small Satellites by IDA (2017)

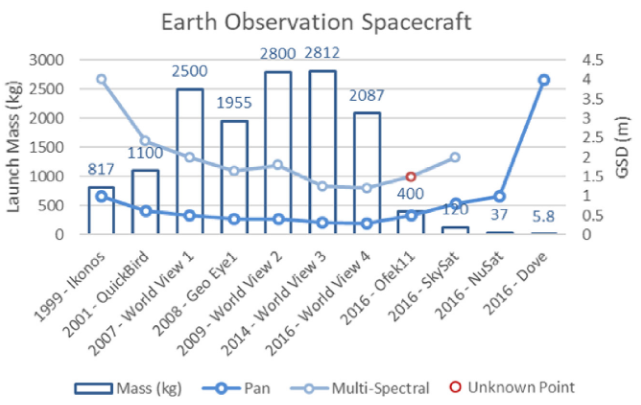

Figure 1 shows the mass of satellites over the years. Though the mass of satellites predominantly varies on the system complexity – payload specs, onboard systems and planned lifetime, we can observe that the mass of satellites has decreased over time since 2005. Further, it can be observed from Figure 2 that the mass of EO satellites to achieve similar performance has decreased over the years. Moreover, with the boom in the small satellite industry, each market segment has been commoditised and modularised.

Figure 2: Small EO Satellites – mass and GSD – Source: Small satellites an overview and assessment, Acta Astronautica 2020

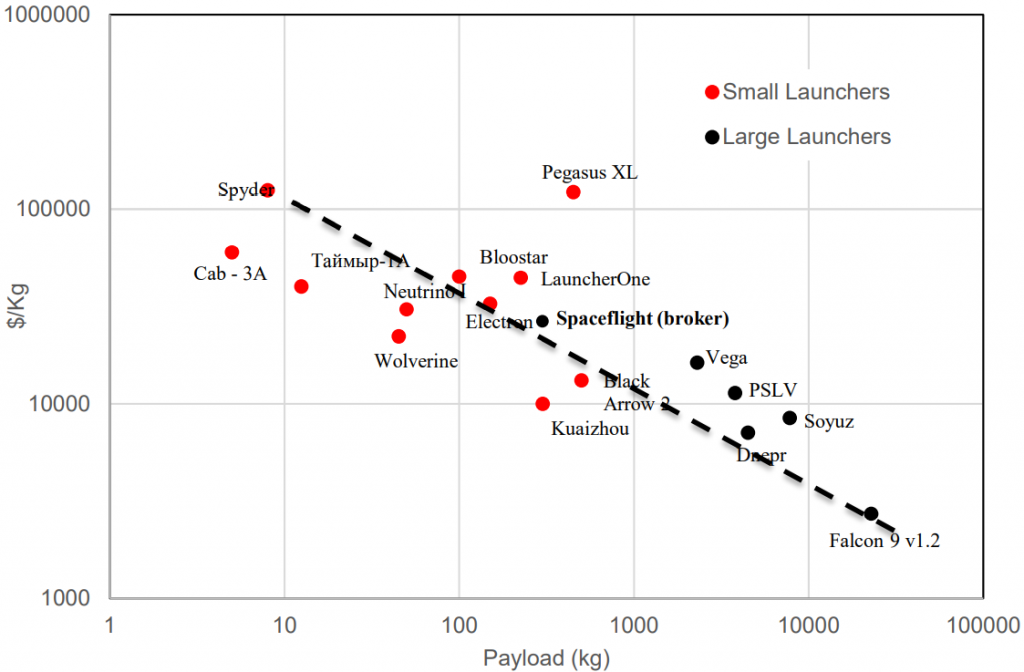

Some companies handle the entire end-to-end lifecycle of a satellite mission like design, manufacture, AIT, launch and operate, to provide just the requisite data. If the pockets are deep enough (>$4-5M), a ‘big enough’ satellite can be ordered as per your requirements, and all one has to do is sit tight to obtain the data. As the mass of satellites decreased over the years to achieve the same performance, the cost to build and launch has also depreciated. The commercial launch industry is also taking off to bring down the cost/kg to orbit with dedicated smallsat launchers and rideshare opportunities on medium-to-heavy launchers, as seen in Figure 3.

Figure 3: Launch cost for different launch vehicles – Source: Global Trends in Small Satellites by IDA (2017)

Hence it is easier than ever before to build, launch and operate satellites. However, it must be cautioned that the launch cost cannot be assessed just by the cost/kg metric8 .

Currently, there are more than 25 private companies worldwide operating EO satellites. However, when it comes to the satellite EO industry to impact our daily lives, it is yet to reach that level due to limited commercialisation and scaling. So one wonders as to what is stopping this commercialisation? More than 400 operational EO satellites (optical and SAR) send 100s of TBs of data every day, of which the market is mainly driven by a handful of 2-3 companies worldwide. Nevertheless, access to high-res optical EO data is still a cumbersome process. Joe Morrison has already written an excellent piece on the reason behind it9.

Despite many predictions by research firms from 2015-16 onwards based on the assumption of increasing supply, the retail pricing per sq.km of images for good quality hi-resolution EO data has not decreased. However, we saw earlier that the cost of building and launching satellites have plummeted over the last decade, so why is that?

While marketplaces have come up to aggregate the data available out there, they are solving the issue of data access and not more data sales because, for that, the demand has to be elastic. These marketplaces are aggregating data from satellite operators, which could theoretically fuel the demand for EO data beyond the defence and intelligence vertical.

But do these marketplaces have enough bargaining power with the incumbents to convince them of reducing their retail pricing or model? Perhaps not right now, hence the industry will continue to be dominated by defence and government requirements, who will be the significant customer as discussed in SatSure Space Jam 01. Every NewSpace EO company assures disruption and democratisation of EO data. However, they either end up being acquired by a larger company, bullied by large customers, or worse – go bankrupt and shut their shops. Still, this has not stopped VCs from pouring capital into establishing new companies despite industry experts’ prediction that this upstream EO industry bubble is set to deflate soon¹0 .

The issue of the EO industry not becoming as mainstream as a SatCom or Satellite-based navigation industries is mainly due to the following reasons as we see it from a downstream perspective.

1. Lack of innovation in the downstream industry

Traditionally, the technology constraints around building and launching satellites have driven the business and use-cases for the downstream applications industry. In the past decade, there has been much innovation in the upstream industry. However, the same cannot be said on the downstream side. If the SatCom industry benefited from DTH operators who built content, location-based services became a necessity for every consumer and enterprise service. The same has not happened in the case of satellite EO, where the dream of disruption by downstream actors is mainly driven by cloud computing or applications of ML/AI techniques to automate and mine for insights in the pool of data. However, there still remains the identification of those few radical end use-cases where the business scalability can be compared with those in the SatCom and the Navigation industries. Albeit, there is little incentive to develop real commercial applications using satellite images when a large customer takes up a considerable chunk of the satellite capacity. This is one industry that prefers high customer concentrations, and investors push for it too!

Such breakthrough innovations will emerge only when the ideas are derived from the first principles. When more and more people outside the space bubble – like economists, public policy and governance professionals, environmentalists, people from the financial sector, etc, are included. Well, after all, the use case of monitoring agriculture lands via satellites for insurance payouts was envisaged when ESA had a user workshop meet, where professionals from the insurance industry were invited. The end applications must drive the innovations on upstream.

2. Design of the upstream services or satellites aren’t driven by the requirements of the downstream.

Usually, EO satellite companies start building satellites based on a market survey or feedback from industry consultants. Furthermore, those companies then start building applications along with selling their images, hence trying to integrate vertically. In comparison, that is not the case when it comes to SatCom, where the user requirements dictate the number of transponders, frequency, throughput and coverage. While, such is not the market power of any well-established satellite data analytics company today, as most of the revenues for satellite operators come from defence. Also, most such companies are made up of data scientists and remote sensing engineers, not space hardware designers who can connect the nuances and sentiments of end-users as requirements for the type of satellite(s) that would help produce the best analytics and help capture the maximum value with commercial customers.

Such downstream to upstream vertical integration is yet to be seen in the EO industry. And the system engineer responsible for the design and development of such satellites has to be aware or made aware of market scenarios and requirements to solve the shortcomings of the EO industry. It is no surprise that innovation spurs only when there is a right amalgamation of end-use applications and state-of-the-art technology available at hand. Moreover, when the right customer segment target is identified, the system must be designed and developed for that particular application to achieve a cost-performance optimisation¹¹. This trend is recently observed in the NewSpace industry, with EO companies coming up to build payloads to target a specific use-case.

3. Performance metric of satellite images are yet to be standardised

The EO industry mainly talks about GSD and Signal-to-noise (SNR) when describing the quality of image data. However, just the GSD, SNR or even the Modulation Transfer Function (MTF) in that case does not describe the complete information. That is mainly because the information depends on whether each pixel downlinked is usable or not. A standard performance metric for EO data is yet to be defined Maybe it can be a combination of GSD, SNR and MTF? SatCom has already figured out the metric as cost per GB or throughput. On a similar line, we at SatSure believe that an accurate metric for the EO industry is the ‘cost per usable bit’ downlinked. This captures the cost of every bit of a pixel that is downlinked and can be used to generate a product. And it would be interesting to analyse the performance of EO satellites using this metric. Hence, we believe that a satellite designed with the right first principles approach, like the Sentinel Program of the European Space Agency (ESA), can only lead to the development of downstream data products for humanity’s betterment. And to achieve that without the deep pockets of public space agencies requires innovation on the upstream segment too, and there is still much scope for innovation in satellite hardware.

Proper commercialisation of satellite EO data will only happen when we can cater to multiple industry verticals by going deep into solutioning, have products whose value proposition is tightly tied around the business performance metrics, and doing all of this without discriminating in prioritising satellites’ allotment or tasking capacity, while maintaining a price-point that closes the business case for the customers. The prospect of processing images onboard orbiting satellites promises to meet some of these requirements. The concept of edge processing is just getting evolved, and we at SatSure expect to leverage that by downlinking just the insights instead of the whole image, further cutting down on ground station costs.

Furthermore, considering the crowding of Low Earth Orbits lately, it is high time people focus on building a larger field of view sensors for higher coverage area with a few satellites instead of launching a constellation with hundreds of satellites to achieve global coverage. The risk of collision in orbit has never been higher than now, and it is a limited resource that has to be used sustainably. These design philosophies, coupled with identifying the use cases and solutioning for those applications with the best products that can be scaled, will help achieve the economies of scale that can be made affordable to increase the usage further and explore different use cases to ignite any innovation.

On an ending note, we explore one idea (which might not be feasible) which can potentially help to commercialise EO data. Aravind Ravichandran talks about the iPhone moment in the EO industry¹² . But can we get the EO data directly to the iPhone? Perhaps not the image itself, but some insights that are easily consumable? Moreover, if we manage to get the data onto the phone, what are the possibilities of applications? SatCom companies like Lynk are already attempting to connect regular handheld mobile phones to satellites. Further, Starlink has already demonstrated connectivity to homes. These use-cases show a promise in achieving mass adoption of SatCom services and hence low-cost on the end-user. Can we attempt something similar in the satellite EO industry? Where we enable the end-user to downlink the insights directly to a regular mobile phone or a laptop connected to the internet. The latter is almost there, with infrastructure like AWS and Azure’s ground stations facilitating to get the data from satellites on the internet. However, that data has to be processed through a long pipeline to make it usable.

Only when we make the EO data more accessible, usable, and contextualised can we empower the end user to unearth its endless possibilities.

This article was originally published in The SatSure Newsletter (TSNL)